DC Car Accident Claims Against Friends

Navigating the aftermath of a DC car accident claim can be complex. You are already possibly emotional due to the loss of life, loss of your car, at least temporarily, inability to work due to injury, and potentially severe physical pain. When you throw in the mix that the tortfeasor who injured you is a friend, your case becomes that much more complicated. While you may be in severe pain, your friend may be too. While you might not know how you will afford your car repairs and medical treatment, your friend may be equally as lost. Empathy is an important quality; no one should tell you that you should be angry at your friend if the accident was due to carelessness. Unless it was due to something reckless like drunk driving or texting and driving, it was likely just a mistake.

But it was not harmless. You may be left with thousands of dollars in repair costs, not to mention thousands of dollars in hospital bills and physical therapy. What is worse, your insurance carrier will refuse to pay for these costs if you were not at fault for the accident. They know that your friend’s insurer is ultimately responsible for your injuries. Insurance companies are not known to make payments when they do not have to. So, why should you be stuck paying these bills out-of-pocket if you did not cause the car accident? This guide focuses on DC car accident claims against friends. We will show you how to handle this dilemma’s personal and legal aspects.

Impact on Insurance Rates

This is perhaps the most critical section to note. Whether you make a claim with your friend’s insurance provider or not, their rates are going up. Otherwise, they likely will not be able to afford to pay for the property damage to their vehicle, the property damage to the car they hit, and the medical treatment for themselves and the other parties in the accident. So, they already are going to be on notice. And not putting them on notice of the accident would be an issue in and of itself. Accordingly, while it may sound immoral to make a claim against your friend, the reality is that it has no impact on your friend’s insurance rates. The only person on whom it has an effect is you.

Your friend should not want you to foot the bills alone for your time missed from work, your medical expenses, and any other expenses related to the accident.

Impact on Personal Relationships

On the personal side, we recommend communicating with your friend about what is happening. They may initially not like the idea of you making a claim with their insurance carrier. They may worry that you will get their rates to increase. However, the reality is that their negligent driving, resulting in an accident, is causing their rates to increase. The fact that you now have bills to pay has nothing to do with that. Open and honest communication between friends is vital throughout the claims process. It’s important to clarify that the claim is against the insurance policy, not personally against the friend, to help preserve the relationship.

We also recommend being transparent. Do not try to hide this from your friend. After your friend’s DC car accident, their life may be turned upside down. While insurance will cover most of their bills, the injuries and car maintenance required can be fatiguing. Moreover, they may be feeling guilt for the pain and suffering you are going through.

Navigating the Insurance Process

If you are in this type of accident, you likely were a passenger in the car. This means there is almost zero chance that you are responsible for the accident. The other scenario in which you may make an insurance claim for a car accident against a friend is if you are in your car and your cars collide. However, in this scenario, insurance carriers will suspect insurance fraud from the jump. We have handled cases in our 70 years of practice where friends look to sue each other for this scenario. Insurance carriers are quick to deny these claims, alleging collusion. At trial, we still have the duty to prove the elements of negligence. The defense may raise as an affirmative defense that it was intentional and a ploy to collect an insurance payout. But of course, this is the more rare scenario.

The typical scenario is that you are a passenger in your friend’s car in the DC accident. When this happens, you may still be able to make a PIP claim. But remember that personal injury protection (PIP) in DC is less valuable than in Maryland. But if you are a Maryland resident and were one when you entered your insurance contract, this should not apply to you. If you were a DC resident when you entered into your contract, then you typically must choose between making a liability claim and a PIP claim. The exception to this rule is if the liability coverage does not cover all your damages. Only then may you make a claim for both.

Liability Claim

Beyond PIP, you can make a claim with your friend’s insurance policy, like in any other case. If your friend does not have coverage, you may be able to use coverage on a car at home. This is known as an uninsured motorist claim or UM claim.

If you cannot successfully claim with your friend’s insurance carrier, you will ultimately need to file suit against your friend. But this is not as precarious as it sounds. While you would be naming your friend as the defendant, his insurance carrier would maintain his defense and pay your damages as if we settled the case.

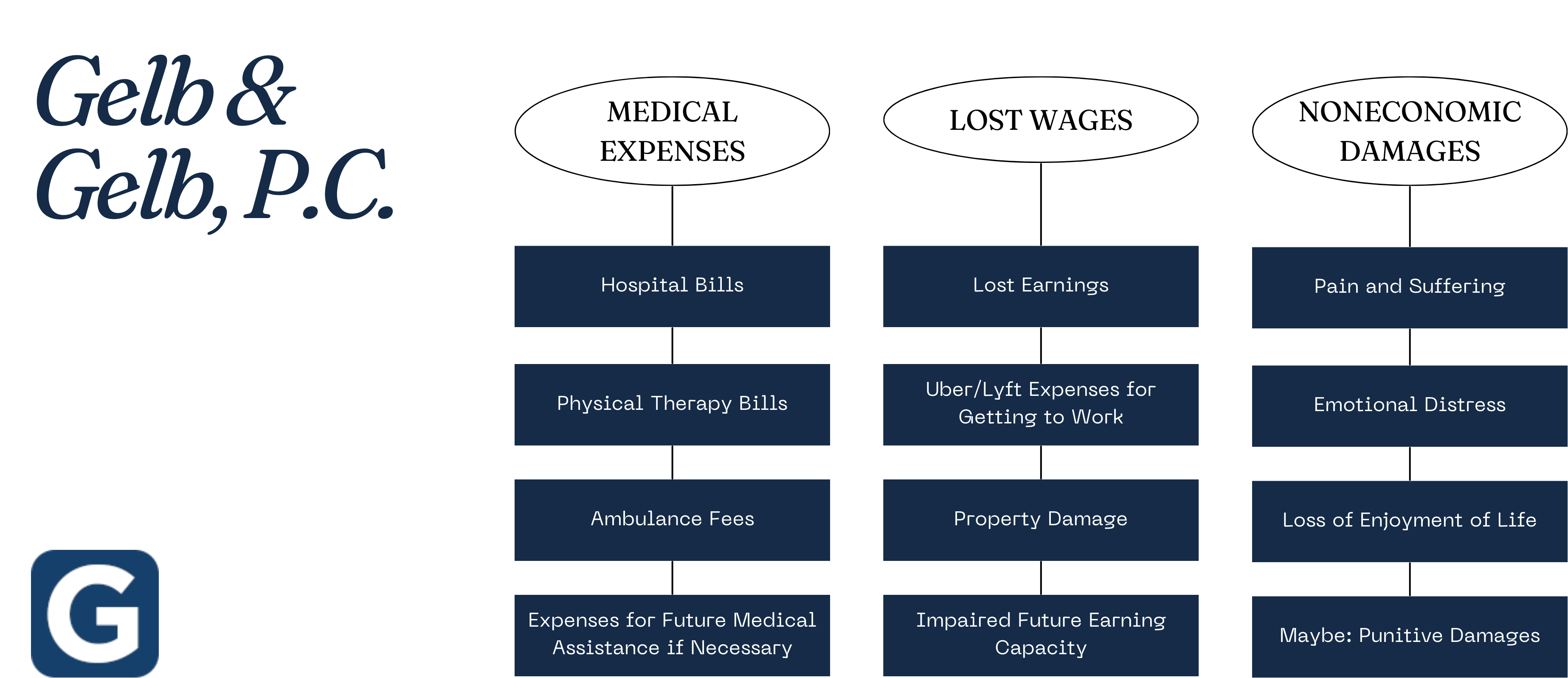

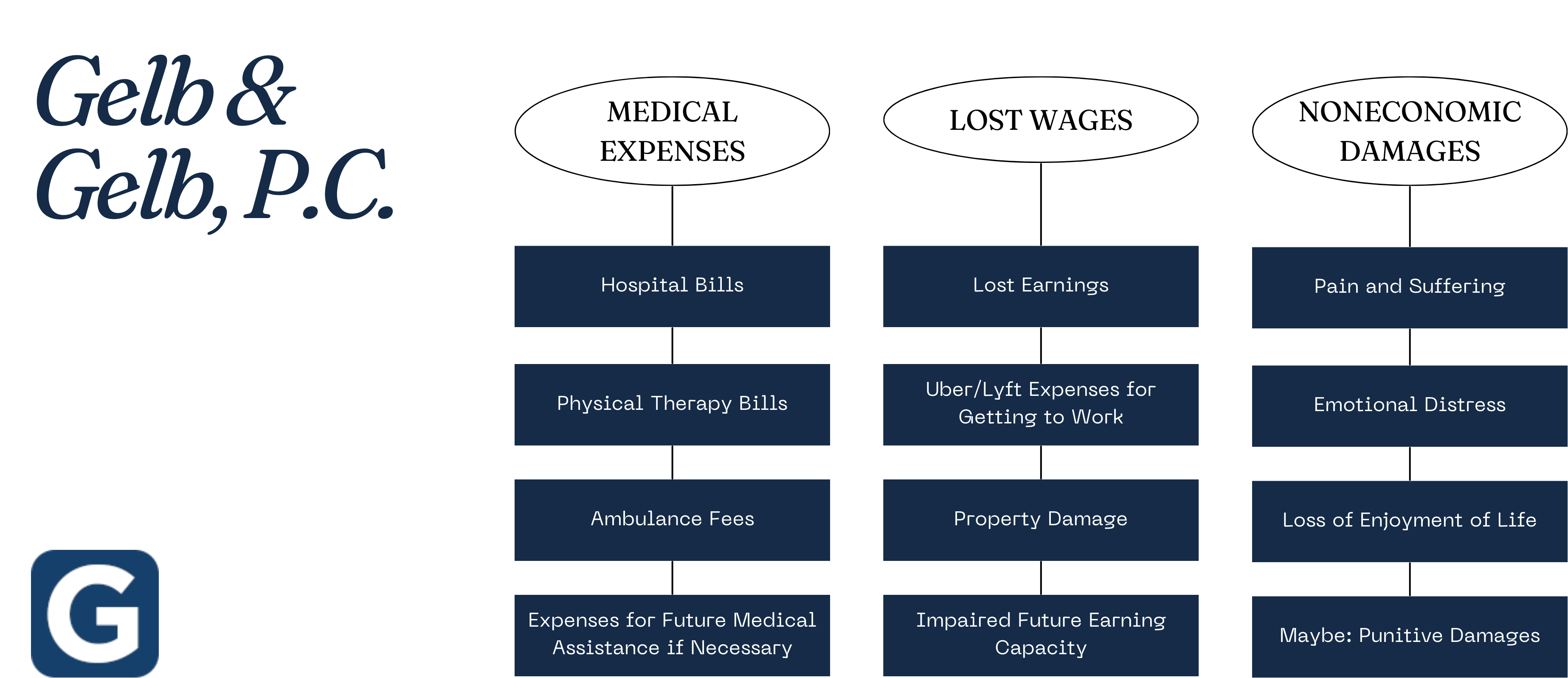

Getting Compensation After a Car Accident

Compensation in a DC car accident claim against friends is structured the same as it is against anyone else. The only difference is that there is no property damage claim. Chances are, it was not your car that was damaged. Accordingly, you will not require compensation to get your car repaired. Moreover, you will not need compensation for Uber costs like some clients who lack transportation after their car is totaled in an accident.

So, what can you receive compensation for? In Washington, D.C., all medical expenses causally related to the car accident are compensable. This makes sense. The purpose of compensation for a car accident is to make you whole. Thus, there is no reason to obtain compensation for property damage if it was not your car. However, you should not be left paying out of pocket for a car accident you did not cause. However, we still must present your bills and records to the insurance carrier and show that it was causally related to the car accident caused by your friend. You also may recover your lost wages.

However, there are a number of caveats that go into this claim. The most important one relevant to a DC car accident claim against friends is that you must be excused from a doctor for the time you missed from work to recover lost wages.

Lastly, you may recover compensation for pain and suffering. This accounts for the loss of enjoyment of life due to your injuries. It also accounts for the amount of pain you were in because of the accident. The more serious the accident and the more hurt you are, the more money you should receive for pain and suffering.

Speak With a Personal Injury Attorney

Our personal injury lawyers at Gelb & Gelb have been practicing injury law since 1954. We have handled over 10,000 cases and stand ready to assist you with your claim. Call us today at (202) 331-7227.

N/a

N/a